Northwest Reverse Mortgage: Your Trusted Reverse Mortgage Specialists

Established in 2019 in Clackamas, Oregon, Northwest Reverse Mortgage was founded with a singular mission: to provide our clients with an exceptional, tailored loan experience. Owned by Jeff Foody, who brings over two decades of expertise in the reverse mortgage industry, we focus exclusively on reverse mortgages. This specialization allows us to refine our systems and processes to meet the unique needs and preferences of our clients. We are proud to be licensed in over 20 states across the United States.

Expertise and Specialization

As dedicated reverse mortgage brokers, we offer a range of products and programs tailored to your needs. Our team's extensive knowledge and friendly service make us the ideal guides through the reverse mortgage application process.

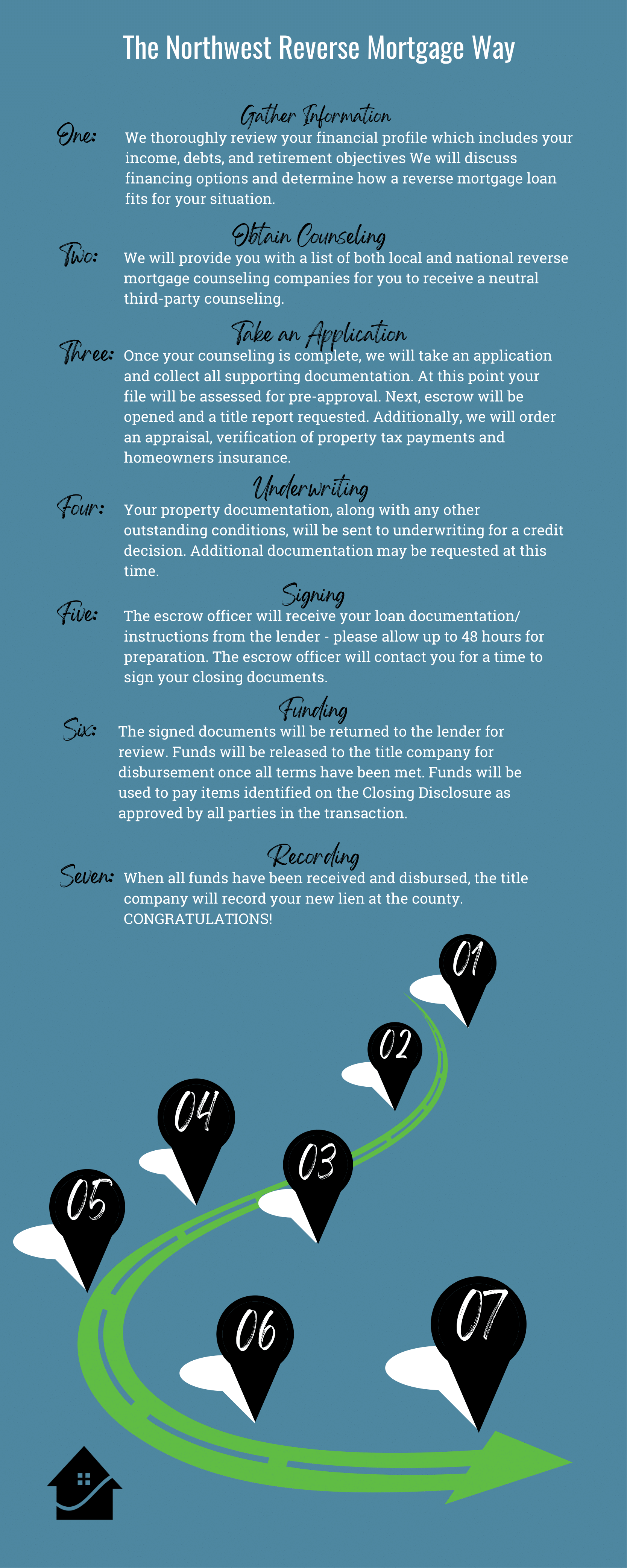

Our Reverse Mortgage Application Process

Initial Consultation: We begin by discussing your circumstances and goals, and collaborating to create a plan best suited to your individual needs.

Guidance and Transparency: Our qualified and knowledgeable staff ensure transparency at every step, providing accurate and timely information so you can make informed decisions.

Comprehensive Expertise: Whether you aim to refinance your current residence, purchase a new home, or access equity through a proprietary or jumbo reverse mortgage, our expertise covers all types of reverse mortgages.

Commitment to Service

Northwest Reverse Mortgage is committed to being there for you throughout the personalized reverse mortgage application process, moving at a pace that suits you. We never rush or pressure you into making decisions before you are ready, understanding that we are working with your future.

Our goal is to empower you with the knowledge needed to make the best decision for your family. We take our role as your local reverse mortgage broker seriously and look forward to guiding you toward a secure future.

Experienced and Dedicated Team

When you work with us, you will be partnering with some of the most experienced reverse mortgage experts in the industry. Our team focuses on collecting and reviewing your documents and preparing your loan for underwriting approval. Below, you can read more about our process and what to expect when choosing Northwest Reverse Mortgage as your broker.

At Northwest Reverse Mortgage, we ensure you are comfortable and well-informed about the reverse mortgage application process, providing a seamless and supportive experience from start to finish.

The Reverse Mortgage Process

The Reverse Mortgage Application Process

When you apply for a reverse mortgage with us, we will review your basic information and collect documentation to process your application. Our staff and lenders will carefully review these documents to determine your qualification for a reverse mortgage. To expedite this process, please have the documents listed below ready to provide to us via mail, email, fax, or in person. Ensure all documents are complete, legible, and intact.

Required Documents for the Reverse Mortgage Application Process

Please prepare the following documents:

1. **Signed Application Documents:**

- Including your counseling certificate.

2. **Identification:**

- A legible, currently valid copy of your Driver’s License, ID card, or passport for all borrowers (including a non-borrowing spouse).

3. **Social Security Information:**

- A legible copy of your Social Security card (you may be able to order it at http://www.ssa.gov under MySocialSecurity).

4. **Bank Statements:**

- A copy of your entire most recent bank statement showing the deposit of social security or other retirement income. Include all pages, even if they are blank.

5. **Homeowner’s Insurance:**

- A copy of your current homeowner’s insurance declaration pages or the name, phone number, and email of the current insurance agent.

6. **Mortgage Statements:**

- A copy of each of your most recent Mortgage Loan Statements for ALL properties owned, not just the property involved in the Reverse Mortgage (Lender requirement).

7. **Social Security Awards Letter:** (you may be able to order it at http://www.ssa.gov under MySocialSecurity).

Additional Documents (if applicable)

Please include the following documents as applicable:

- **Trust Documentation:**

- A copy of the trust, if there is a trust.

- **Homeowners Association Information:**

- Contact information, if applicable.

- **Pension Award Letter:**

- If applicable.

- **VA Disability Benefits Letter:**

- If applicable.

- **Tax Returns:**

- We do NOT need tax returns unless claiming rental or self-employment income or capital gains. Include all pages, even if they are blank.

- **Employment Documentation:**

- 30 days of most recent pay stubs and the most recent W2, if employed.

Additional Information

Depending on your loan or home type, additional documents may be requested as your loan progresses. Providing these documents promptly will help us process your loan efficiently. For any questions or guidance on collecting these documents, please reach out to us.

To apply for a loan with us, fill out the form on this page or call us directly at 800-806-1472.