Safeguarding Your Retirement Planning During Economic Recessions

Retirement planning can begin at any time, but most people begin seriously considering retirement in their 30’s. For many of us, life gets in the way of the best laid plans and retirement planning doesn’t always go as intended. No matter when you start retirement planning, the success of your plan depends on many factors…

Read MoreShould Jack and Diane get a Reverse Mortgage?

Jack and Diane are considering a reverse mortgage. They have been married for 40 years. They raised a family together; 3 kids and 3 grandkids with another on the way. Jack’s football dreams ended after college, but he secured a great life for his family working for the city. That career allowed Diane to stay home…

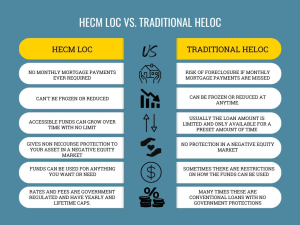

Read MoreGetting a HELOC in Oregon, Washington or Idaho

When deciding on getting a HELOC in Oregon, Washington or Idaho, you must be aware that there are many different kinds of HELOCs available to choose from. Banks, lenders, and mortgage brokers offer various traditional HELOCs that have their own terms and conditions. The kind of HELOC you choose depends on your goals and your…

Read MoreQualifications for a Reverse Mortgage

Wondering if you meet the qualifications for a reverse mortgage? Thanks to reverse mortgages, many senior homeowners have been able to make home improvements, travel, pay off medical expenses, or supplement their income by tapping into their home equity. Reverse mortgages have become much safer, more accessible, and more popular thanks to the current Federal Housing…

Read MoreRetirees Reconsider How to Use Home Equity

-Written by Robin Rosa MLO #1402813, Reverse Mortgage Specialist Much damage has been done to the U.S. economy in the last two years causing retirees to reconsider how to use home equity. The COVID-19 pandemic coupled with shutdowns and central banks’ efforts to stimulate the economy has left the financial markets and world economies on…

Read More6 Things to Consider Before Getting a Reverse Mortgage

If you are considering getting a reverse mortgage, you may have done some research or even know someone who has one. Getting a reverse mortgage is an excellent way for people 55 years and older to convert their home equity to cash that they can use for additional retirement funds, home improvements, or medical expenses. Reverse mortgages allow the homeowner to…

Read MoreNavigating Your Retirement Journey: Choosing a Reverse Mortgage Specialist

When it comes to exploring the realm of reverse mortgages, having a qualified guide is paramount. While an MLO license may grant someone the title of a reverse mortgage specialist, the true measure of expertise goes beyond certification. Clients and their support teams must engage in due diligence to evaluate the experience and proficiency of…

Read MoreHow Does a Reverse Mortgage Work?

Understanding How Reverse Mortgages Work You have probably seen commercials and heard your friends discuss reverse mortgages but they sound complicated. We get that so, we have broken down some of the basics around “How Does a Reverse Mortgage Work?” in this article. Reverse mortgages are loans for seniors 55 and older who want to…

Read MoreThree Types of Reverse Mortgages

You may have heard about reverse mortgages and thought they weren’t suitable for you. You may think they are too confusing or that you probably won’t qualify. However, reverse mortgages offer simple solutions to homeowners 62 and older who want extra funds for paying bills, traveling, or assisting in medical expenses by using the equity…

Read MorePros and Cons of a Reverse Mortgage

Reverse mortgages have become popularized by television commercials anchored by celebrities. To some, they may seem too good to be true. But reverse mortgages are not all Hollywood glitz and glamour. They are a way for homeowners, now as young as 55 or older, to convert the equity in their homes into spendable cash. Though…

Read More